The National Housing Shortage Cause and End

By Ben Caballero

[This column was first published by Inman News.]

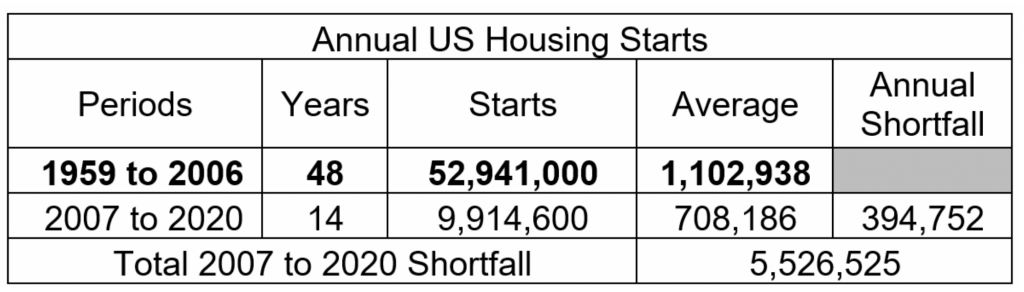

May 12, 2021 — US Census Bureau began recording housing starts in 1959. During the 48 years between 1959 and 2006, builders started 1,102,938 homes per year totaling 52,941,000 homes. For the 14 years between 2007 to 2020, builders started 708,186 homes per year totaling 9,914,600 homes. The average annual shortfall is 394,752 below the historical average and equals a shortfall of 5,526,525 homes for those 14 years. In 2020 builders started 990,500 homes, still below the historical average of 1.1 million annual starts. See table below.

Home buyers are now paying the price for the 5.5 million homes that builders did not build during the 2007 to 2020 period. However, the need for homes has not only continued but was intensified by a combination of events.

What events are escalating housing demand? It started with the COVID lockdown. The pandemic influenced demand as people were required to live in their homes instead of just visiting them evenings and weekends. People became increasingly dissatisfied with their home’s functional obsolescence as 2 adults try to do business from home, teach their kids in the same place, and live life there as well. So much pent-up demand was unleashed that buyers have been pulled forward from future years on their home buying decision.

Other causes are the population continues to live longer, preventing their homes from being recycled. Millennials began are reaching the home-buying age. Institutional investors entered the market in force. Local, state, and federal restrictions and mandates increased, and interest rates decreased to record levels bringing in more buyers. Population shifts to states like Florida, Texas, Tennessee are experiencing disproportional demand. And as if that were not enough, the immigration crisis at our border will further exacerbate our national housing demand with an additional 1,000,000 or more people that will need to live somewhere.

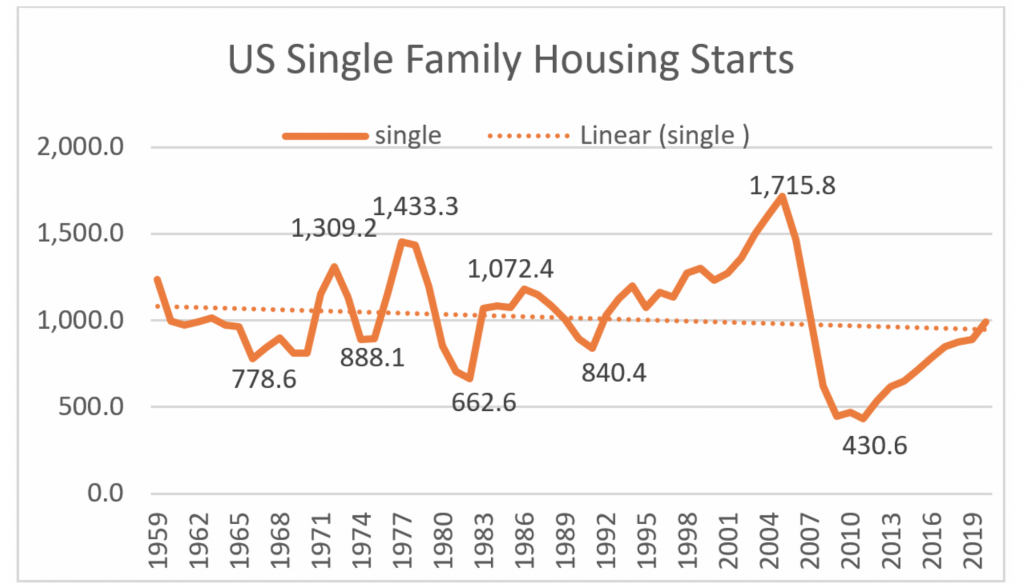

What caused builders to build fewer homes? The home building industry was devastated and still suffers from the disintermediation of labor and manufacturing that began in 2006 and continued until 2012. Production then made a weak advance after housing starts dipped to 430,600 in 2011, a drop of 75% or 1,288,200 fewer starts than the 1,715,800 starts in 2005.

How long will the shortage last is a question many are asking. This question can be answered with simple math. The record shows a starts shortfall of 5,526,525 homes. Assuming builders can increase production by 10% per year, our national home inventory would gain an escalating number of starts per year to apply to the shortfall and could be overcome by 2028 as the charts below illustrates.

Why didn’t builders build more homes? Home building is very sensitive to economic downturns. Since 1959, except for the 1973 OPEC Oil Embargo, economic downturns were caused by changes in federal legislation or policies that affected interest rates or taxes. Federal action is not driving the market today, but its policies are responsible for damaging housing production. For those who do not know or remember, in the early 2000s federal government wanted as many people as possible to own a home. To make that happen, lenders were encouraged (if not coerced) by governmental policy to abandon established lending practices and make risky subprime loans. Consequently, home loans were originated without regard to credit, employment, or down payment. Circumvention of established lending guidelines was facilitated by the unprecedented policies of FHA, FNMA, and FMAC that allowed sellers to gift down payments and closing costs to buyers through third parties. These policies opened the door for unscrupulous real estate agents, mortgage brokers, lenders, and title offices to carry out rampant mortgage fraud. Unqualified borrowers were encouraged to buy homes they could not afford. What followed was an avalanche of foreclosures that triggered the most severe decline in housing values. A 75% decline in housing starts from 2005 to 2011 – the longest and most severe decline since the US census began recording starts data.

Homes values were not the only damage. Some may recall the US government insured most of those failed mortgages. Loans were packaged and sold as low-risk investments because FHA, FNMA, and FRMC backed them. When foreclosures made the loans worthless, FHA, FNMA, and FRMC had to absorb the losses. The losses were so enormous they put the entire US financial system on the verge of collapse. The solution was simple but expensive, as usual a governmental bailout rescued the nation from the disaster it created.

CONCLUSION

Unfortunately, the US housing supply will remain underserved for several years, but if home builders are allowed, they will house America with quality housing unmatched by any nation, provided the government does not help them.

NOTE: Factors not considered include apartment production, changing housing preferences, US immigration policy, interest rate changes, federal tax rates and policy, population growth. The average starts of 1.1 million from 1959 to 2007 does not account for population growth.